The world may not be facing the economic turmoil some were predicting earlier this year but the market still hasn’t been plain sailing for property managers.

Now we’ve reached the halfway point of 2023, we’ve dived into the data to take the temperature of the market during the first six months of the year.

The findings reveal flashes of strength but a very mixed picture. In fact, if we look at the US, Europe and UK — three of the most developed short term rental markets in the world — it’s the US which appears to be struggling more than most.

This could be due to the cost-of-living crisis as inflation strangles disposable income, big increases in the numbers of available vacation homes over the past two years or a combination of the two.

Similar trends have been seen in all major markets but the US is suffering most. Let’s see what that looks like…

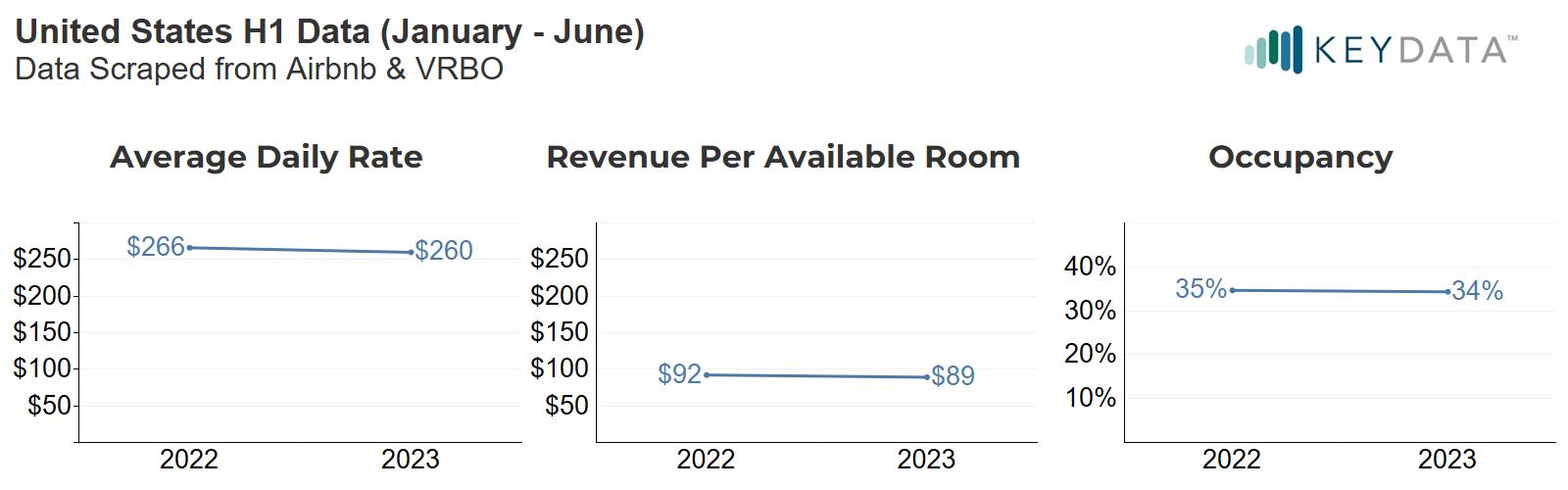

US Half-Year Short Term Rental Performance

The US short term rental market has struggled to keep up with the rest of the world so far in 2023.

While Revenue per Available Rental (RevPAR) increased in Europe, in the UK, and globally during the first six months of the year, it fell sharply in the US, where occupancy hasn’t been making up for softer Average Daily Rates (ADRs).

Global RevPAR rose 5.7% to $49 for stays taken between January and June, largely thanks to an increase in occupancy which offset a modest 2.8% annual rise in ADR to $173. This represents a significant fall in ADR because these figures are not adjusted for inflation, which reached 7.4% in the 38 OECD countries in April, according to latest figures1.

Contrast this with the US and it’s clear the American market has been slowing more significantly, even though nightly rates remain comparatively high. US RevPAR fell 3.3% to $89 in the first half of the year, ADR was down 2.3% to $260, while occupancy was down a single percentage point at 34%. Inflation reached 4% in the US in May (YoY) and the average booking window fell from 45.1 days to 41.2 days — another clue that consumer confidence has been hit.

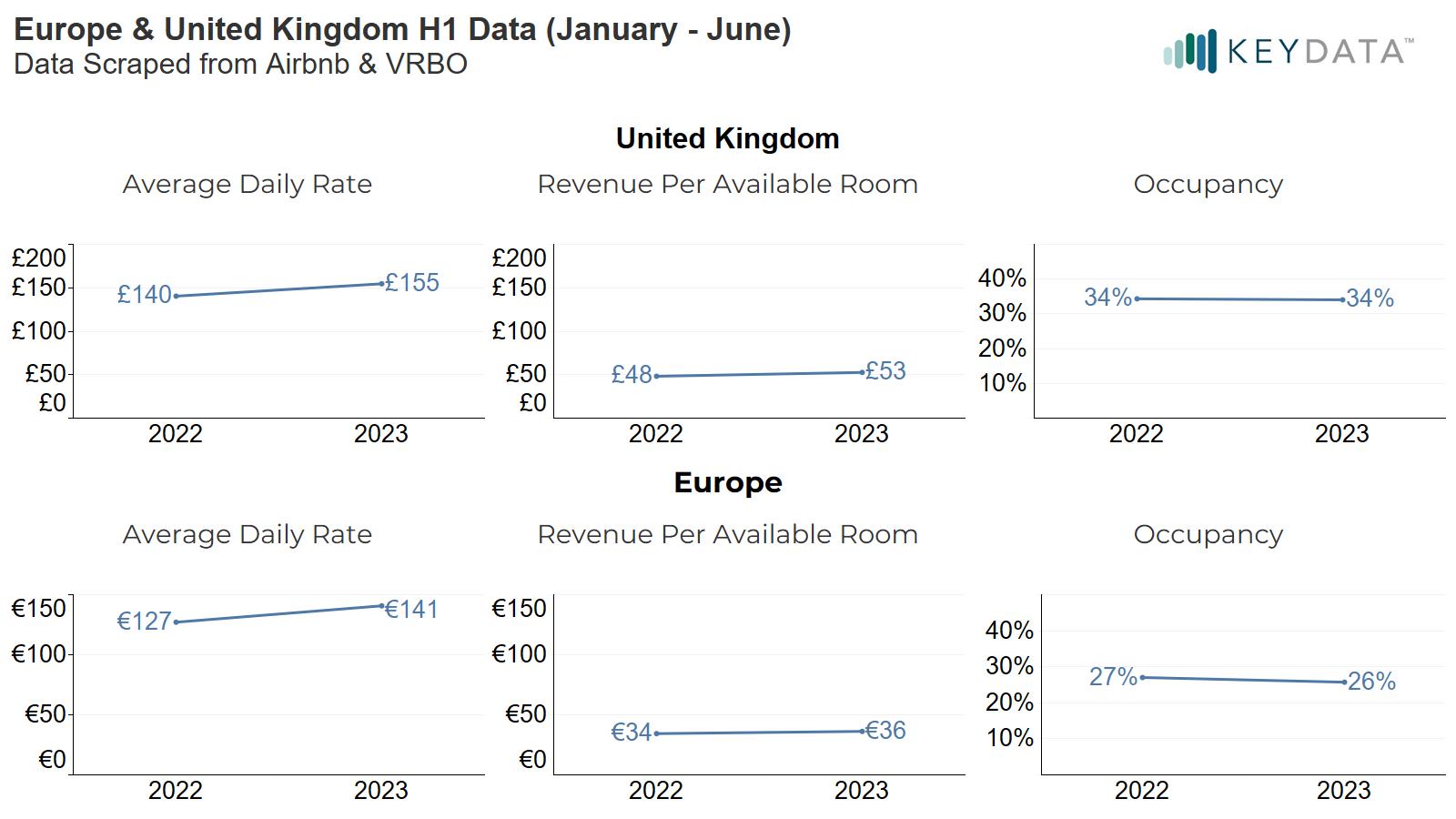

Meanwhile, The Story In The UK And Across Europe Is Very Different

The UK saw RevPAR jump by 9.2% to £53 in the first half of the year, which means revenues are hovering around real-term growth when you consider latest inflation figures put UK CPI at 8.7% in May. Occupancy was down 0.9% at 34% but this was offset by a 10.1% rise in ADR to £155. The average booking window in the UK has declined by 6.3% to 46.2 days.

In Europe, RevPAR was up 5.4% at €36, while occupancy was down 4.8% at 26% and ADRs were up 10.7% at €141. Euro area CPI was 5.5% in June, meaning nightly rates have climbed well ahead of inflation. The average booking window in Europe has grown by 6.2% to 42.8 days.

What’s Next For Short Term Rentals?

If recent performance is anything to go by, these major markets still appear to be on markedly different trajectories. In Q2, RevPAR both in the US and globally weakened, while in Europe and the UK it strengthened, helped again by stronger occupancy and nightly rates.

Outlook For The Future

Looking at ‘on the books’ (OTB) data for Q3 globally, the outlook is far more positive than the previous quarter. Q3 stays are showing an 8.3% year-on-year increase in RevPAR, which probably means the market is back to real-terms growth. Growth in occupancy globally has nearly doubled to 5.6% annually for stays in Q3 so far.

In the US, the market is strengthening. RevPAR is seeing a dramatic swing into positive territory — up 1.3% so far — indicating that, while revenues are still down in real terms, the States may be seeing a turnaround. Occupancy was down 1% annually in Q2 but this quarter it’s up 4.3%, lending weight to this theory.

Across the pond, the UK and Europe are witnessing even more robust annual growth in RevPAR, with a 14.5% jump in the UK and 13% increase in Europe. Revenues appear to be growing well ahead of inflation with occupancy also showing sturdy growth.

Key Takeaways

- Inflation continues to hurt revenues but don’t make the mistake of thinking that higher occupancy automatically improves overall revenues

- Consider leaving it later to reduce average daily rates (ADRs) in case guests are booking closer to their trips, particular in the UK and US where booking windows have been falling

- All markets look to be strengthening in Q3 but US property managers will still have to fight hard for revenue growth by adjusting their strategies in real time

If you want to find out how short term rental market data can improve your business strategy and boost revenues, book a demo in with one of our team members.

.png)